Background

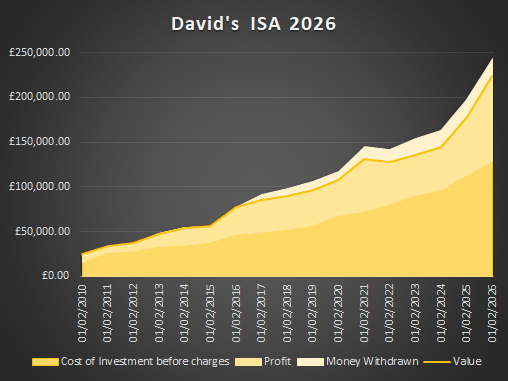

01/02/2026 – This is my Stocks & Shares ISA consisting of over 30 managed funds. Dark yellow line shows value over time. Darkest yellow block shows gross contributions. Medium yellow block shows profit and lightest yellow block shows money withdrawn. Everyone’s ISA will perform differently depending on funds held, amount invested, timescale and charges. £500 per month goes in (at the start it was only £50pm.) I sometimes make additional, lump sum contributions (£10,000 was added in September 2025) and have withdrawn money in the past. I charge the ISA 0.5% per annum for an investment performance review and overall annual charges are shown as 1.73%.

Commentary

Portfolio grew 16.38% over the last 12 months compared with a 12.63% rise the previous year. These returns are well above the expected long-term average. For the first time in a long time, gains were not from US “tech” stocks but U.K., European, Asian and Emerging market equities. This can be explained by a falling US dollar and a slight pivot away from the US by investors.

Fixed interest funds have not performed once again as inflation concerns persist.

ISA benefits

The 2025/2026 UK ISA allowance is £20,000. Consider using up as much of this as possible before the 5th April 2026 deadline. If you do not wish to invest the full amount, you can fill up any unused allowance with a Cash ISA.

The obvious advantage of an ISA is the fund is invested in a virtually tax free environment. If you are a non tax payer, have capital gains below the annual allowance, receive less than £500 p.a. in dividends, or make a loss – these may not seem like advantages. However, it may still be worth placing money into an ISA to protect yourself from future tax charges and admin. ISA money does not need to be included in a tax return.

Compare with last year’s ISA graph

Warnings & Caveats

This investment suits me but may not suit you. Its value can fall, so can the amount of income it produces. I never recommend investing in anything without seeking proper regulated advice – unless, of course, you fully understand the risks and have the capacity to accept the loss.

If you have your own ISA, it may perform differently for the reasons given above.

ISAs are not much use against Inheritance tax as they form part of your estate on death. However, spouses can “inherit” each other’s ISA fund value as an allowance

Please note, I also keep a Cash ISA going for Emergencies. Capital value should be safe from volatility but maybe not from inflation, in the longer term. Deposit interest rates have improved in the last few years but are beginning to fall again.

I can’t predict the future..