10th November 2022 by David Ewens

Explanation

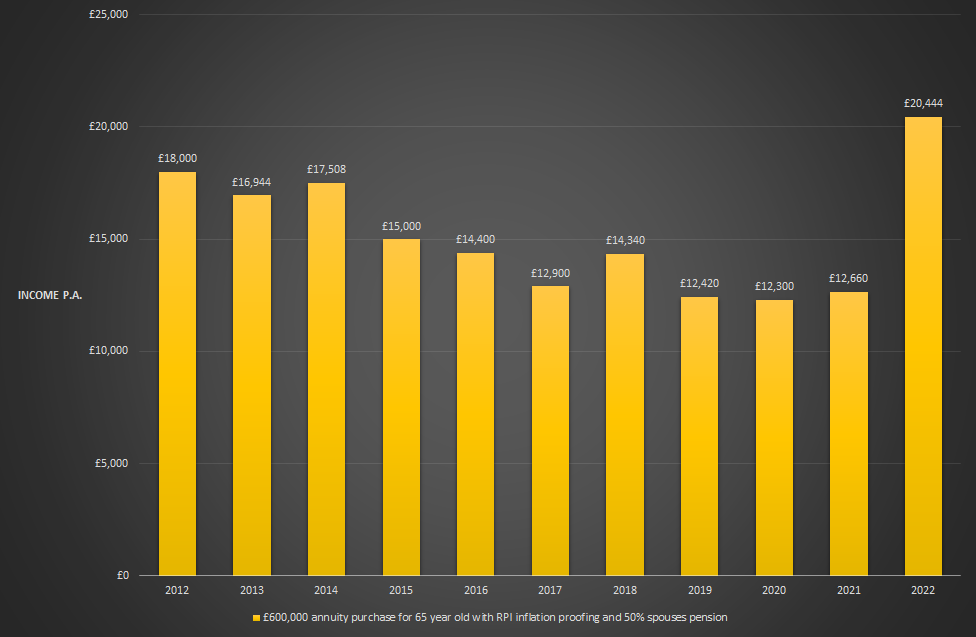

How much guaranteed annual income would £600,000 buy a healthy sixty five year old living in the south of England? Income is pegged to RPI inflation each year and would provide 50% spouse’s income if the purchaser dies first. This graph is a very rough indication only and is based on quotes obtained over the last 10 years.

Caveats

N.B. This graph is intended as a rough guide to show how one particular type of annuity has evolved over the last 10 years. It is not a recommendation to purchase an annuity.

Annuity rates change constantly and are not guaranteed until the annuity company confirms they have the money and have set up the plan.

You may obtain a higher annuity if you have medical conditions or lifestyle factors such as smoker, drinker etc.

Other types of annuity are available which may suit your circumstances better. An annuity may not be the best option for you. You may be able to purchase an annuity from a company other than your pension provider.

I recommend anyone who is unsure of the risks, tax consequences or nature of any financial product should seek proper regulated financial advice before proceeding.