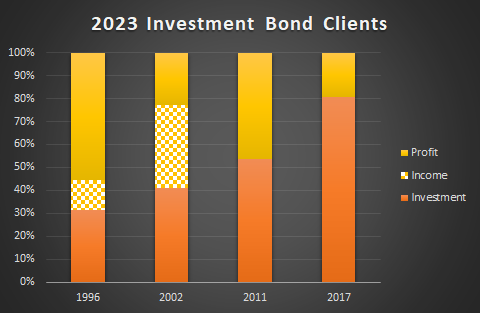

Columns show the amount of profit (in yellow) compared to the amount invested (in brown) for four different clients. Client one invested in 1996, two in 2002, three in 2011 and four in 2017. Chequered yellow and white shows “withdrawals,” which may be viewed as profit already taken. Performance relates to one particular fund managed by one major UK investment provider.

This Investment tries to smooth out short-term volatility experienced by stock market investors by holding back profit from “good” years and distributing it in “less good” years. Returns have been muted over the last 12 months as rising inflation and interest rates dented confidence in virtually all major asset classes – Equities, Fixed Interest securities and Commercial Property.

Compare Investment Bond 2022 Post

Disclaimer: This post is intended for existing clients only to show how one specific investment performed in the past. Figures used to compile the graph are taken from real clients’ annual investment statements. As a result, total profit may include yields from dates other than the starting year if clients added to their bond. You should not consider this post as “advice” to go and buy an investment bond or any other investment. Although this particular bond / fund has done well over time, other bonds have made a loss. We cannot say for certain this bond will perform as well in the future as it has in the past. The word “bond” has a number of different meanings. I recommend anyone who is unsure of the risks, tax consequences or nature of any financial product should seek proper regulated financial advice before getting involved.