Background

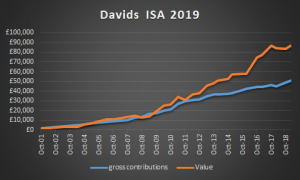

10/03/2019– This is my Stocks & Shares ISA consisting of over 30 managed funds. I charge the ISA 3% on each contribution plus 0.5% per annum of fund value for an “investment performance review”. The orange line shows value after costs and the blue line gross contributions. Everyone’s ISA will perform differently depending on funds held, amount invested, timescale and charges. £350 per month goes in (at the start it was only £50pm.) I sometimes make additional, lump sum contributions and have withdrawn money in the past.

Commentary

Most equity markets fell about 10% during the course of 2018. After nearly ten years of rising values, investors feel global economic growth has to slow at some stage. The threat of trade wars between the U.S., China and Europe was a concern, as was the prospect of rising U.S. interest rates – especially to Emerging Markets who tend to borrow in that currency. A long term investor, drip feeding money, may eventually look back at dips in the graph with fondness on the realisation assets were purchased more cheaply. They may even regret not investing more..

ISA benefits

The 2018/2019 UK ISA allowance is £20,000. Consider using up as much of this as possible before the 5th April 2019 deadline. If you do not wish to invest the full amount, you can fill up any unused allowance with a Cash ISA

The obvious advantage of an ISA is the fund is invested in a virtually tax free environment. If you are a non tax payer, have capital gains below the annual allowance, receive less than £2,000 p.a. in dividends, or make a loss – these may not seem like advantages. However, it may still be worth placing money into an ISA to protect you from future tax charges and admin. ISA money does not need to be included in a tax return..

Warnings & Caveats

This investment suits me but may not suit you. It’s value can fall, so can the amount of income it produces. I never recommend you invest in anything without first seeking proper regulated advice – unless, of course, you fully understand the risks and have the capacity to accept the loss.

If you have your own ISA, it may perform differently for the reasons given above.

Please note, I also keep a Cash ISA going for Emergencies. Returns are not great at present but the capital value should be safe.

I can’t predict the future..