Background

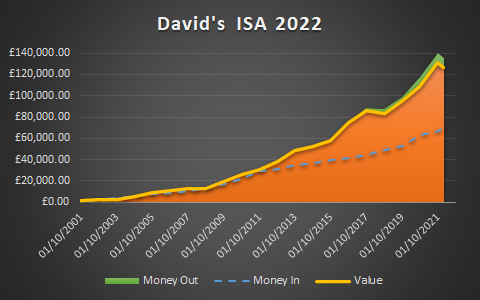

20/02/2022– This is my Stocks & Shares ISA consisting of over 30 managed funds. I charge the ISA 3% on each contribution plus 0.5% per annum of fund value for an investment performance review. The yellow line shows value after costs and the blue dotted line shows gross contributions. Green block shows money taken out. Everyone’s ISA will perform differently depending on funds held, amount invested, timescale and charges. £500 per month goes in (at the start it was only £50pm.) I sometimes make additional, lump sum contributions and have withdrawn money in the past.

Commentary

Most equity markets continued to rise in 2021 as global economies recovered from the initial shock of the Covid-19 pandemic. Values have dropped back since the beginning of 2022, however, on concerns about inflation, rising interest rates and the withdrawal of government stimulus. Fixed Interest funds are likely to fall in value as interest rates rise. After four years of outperformance, we are also starting to see a reduction in US funds as valuations appear a little too optimistic. We currently have geo-political concerns which could cause a sudden shock to global markets depending on the severity and duration of the crisis.

As this is a long-term investment, I try not to worry too much about dips in the market and console myself with the thought I am buying fund units more cheaply and hope they will recover at some point.

ISA benefits

The 2021/2022 UK ISA allowance is £20,000. Consider using up as much of this as possible before the 5th April 2022 deadline. If you do not wish to invest the full amount, you can fill up any unused allowance with a Cash ISA.

The obvious advantage of an ISA is the fund is invested in a virtually tax free environment. If you are a non tax payer, have capital gains below the annual allowance, receive less than £2,000 p.a. in dividends, or make a loss – these may not seem like advantages. However, it may still be worth placing money into an ISA to protect you from future tax charges and admin. ISA money does not need to be included in a tax return..

Compare with last year’s ISA graph

Warnings & Caveats

This investment suits me but may not suit you. It’s value can fall, so can the amount of income it produces. I never recommend you invest in anything without first seeking proper regulated advice – unless, of course, you fully understand the risks and have the capacity to accept the loss.

If you have your own ISA, it may perform differently for the reasons given above.

Please note, I also keep a Cash ISA going for Emergencies. Returns are not great at present but the capital value should be safe.

I can’t predict the future..