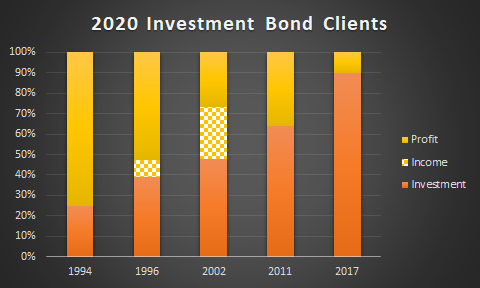

Columns show the amount of profit (in yellow) compared to the amount invested (in brown) for five different clients. Client one invested in 1994, two in 1996, three in 2002, four in 2011 and five in 2017. Chequered yellow and white shows “withdrawals,” which may be viewed as profit already taken. Performance relates to one particular fund managed by one major UK investment provider.

This particular Investment tries to smooth out some of the short-term volatility extremes experienced by stock market investors by holding back profit from the “good” years and distributing it in “less good” years. This has helped protect bond values during the current crisis.

Disclaimer: This post is intended for existing clients only to show how one specific investment performed in the past. Figures used to compile the graph are taken from real clients’ annual investment statements. As a result, total profit may include yields from dates other than the starting year if clients added to their bond. You should not consider this post as “advice” to go and buy an investment bond or any other investment. Although this particular bond / fund has done well, other bonds have made a loss. We cannot say for certain this bond will perform as well in the future as it has in the past. The word “bond” has a number of different meanings. I recommend anyone who is unsure of the risks, tax consequences or nature of any financial product should seek proper regulated financial advice before getting involved.